News

29 Nov 2025

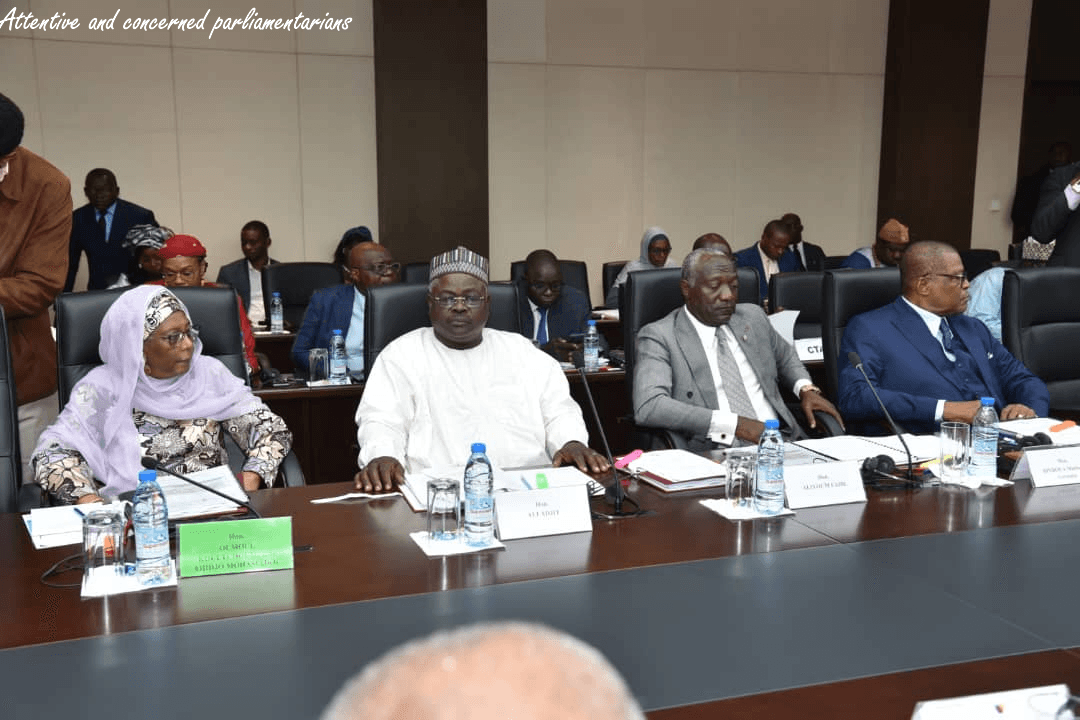

The Audit Bench held on 20 and 21 November forums for exchanges respectively with the finance and budget committee of the National Assembly and then with that of the Senate.

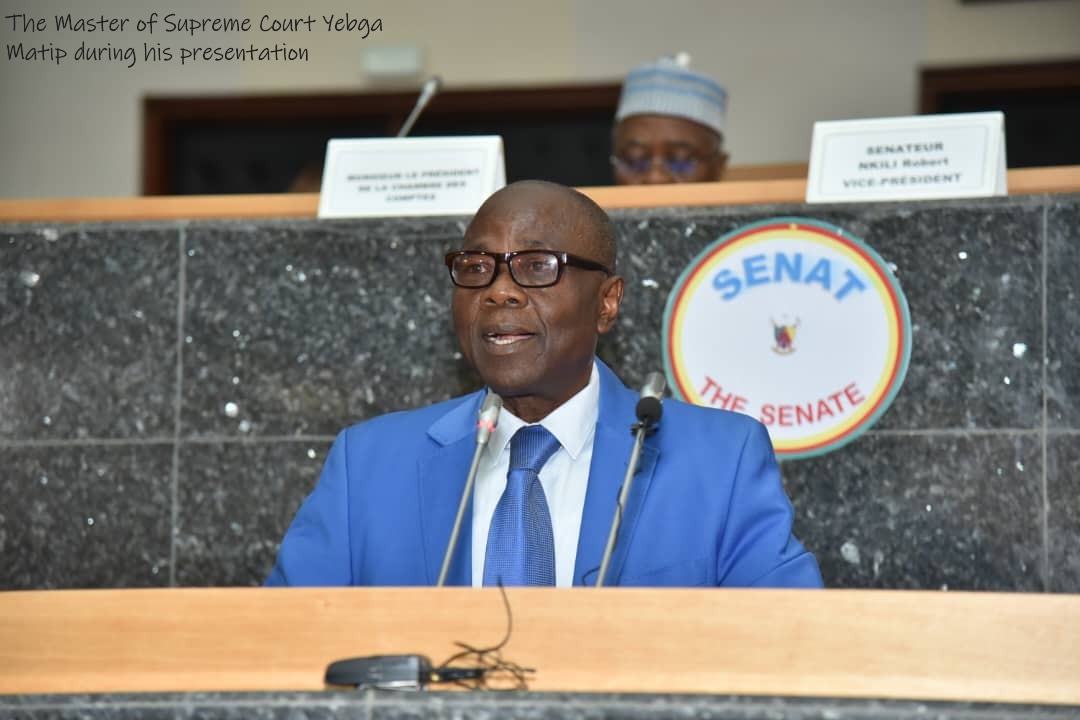

After the protocol moments filled with speeches from parliamentary officials and the address of the president of the jurisdiction, the exchanges focused on a topical theme: ‘The certification report of the State's general account as a tool for aiding parliamentary control of financial laws’ which was presented by Yebga Matip Emmanuel, Master at the Supreme Court.

From this presentation, it emerges that in accordance with the 2018 law governing the financial regime of the State, parliament must examine the settlement law to assess the execution of the last financial law. A key document for this control is the certification report of the State's general account (CGE), produced by the Audit Bench of the Supreme Court. This certification aims to ensure the regularity, sincerity, and fidelity of public accounts.

Since it has been carrying out this mission, the Audit Bench has consistently issued an unfavourable opinion on the certification of the CGE. This position is based on the non-observance of the normative framework, ranging from the State's accounting reference framework to international audit standards (ISSAI).

The unfavourable opinion is based on major irregularities that limit the understanding of the real assets of the State:

· Incompleteness of assets: the inventory of the State's assets is still ongoing. For example, in 2024, a significant part of tangible and intangible fixed assets, as well as almost all inventories, are still not included in the balance sheet.

· Non-compliance with principles: absence of depreciation on the recorded tangible assets, abnormal meanings of the balances of certain accounts (such as the account "Special Fund Covid-19"), and non-assessment of the risks of non-recovery of tax debts and deficits of accountants.

· Limited clarity: despite recent progress, these anomalies mean that the financial statements do not provide a ‘true and fair view of the assets and financial situation of the State.’

Notable progress has, however, been observed, indicating better involvement from the Ministry of Finance (MINFI). The principle of the intangibility of the balance sheet has been respected for the 2024 financial year (faithful reporting of balances). The annexed State document, essential for understanding the accounts, has been produced for the first time. Better collaboration has been established between the General Directorate of the Treasury of financial and monetary accounting and other directorates (Taxes, Customs, etc.).

Despite its role as a compass for control, the report's impact is limited by procedural factors. The CGE is forwarded to the Court of Auditors and parliament late. Furthermore, the jurisdiction is not systematically invited to present its audit findings before parliament, which hinders the exploitation and understanding of its findings.

However, the certification report remains a crucial lever for controlling financial laws, particularly by enabling the reconciliation of budgetary revenues (PLR) and accounting products (CGE). To maximise its utility, the Court of Auditors recommends: adherence to transmission deadlines, increasing its financial resources, and establishing systematic follow-up of its recommendations by the government and parliament.

not to be missed

Rôle de la séance de délibéré de la 2ème section du vendredi 12 décembre 2025

L'audience débutera à 9h30.

Read more

Rôle de l'audience publique ordinaire de la 2ème section du 14 novembre 2025

L'audience débutera à 9h30.

Read more

Rôle de l'audience publique ordinaire de la 2ème section du 24 octobre 2025

L'audience débutera à 9h30.

Read more

Rôle de l’audience publique ordinaire de la 3ème Section du 29 octobre 2025

L'audience débutera à 9h00

Read more